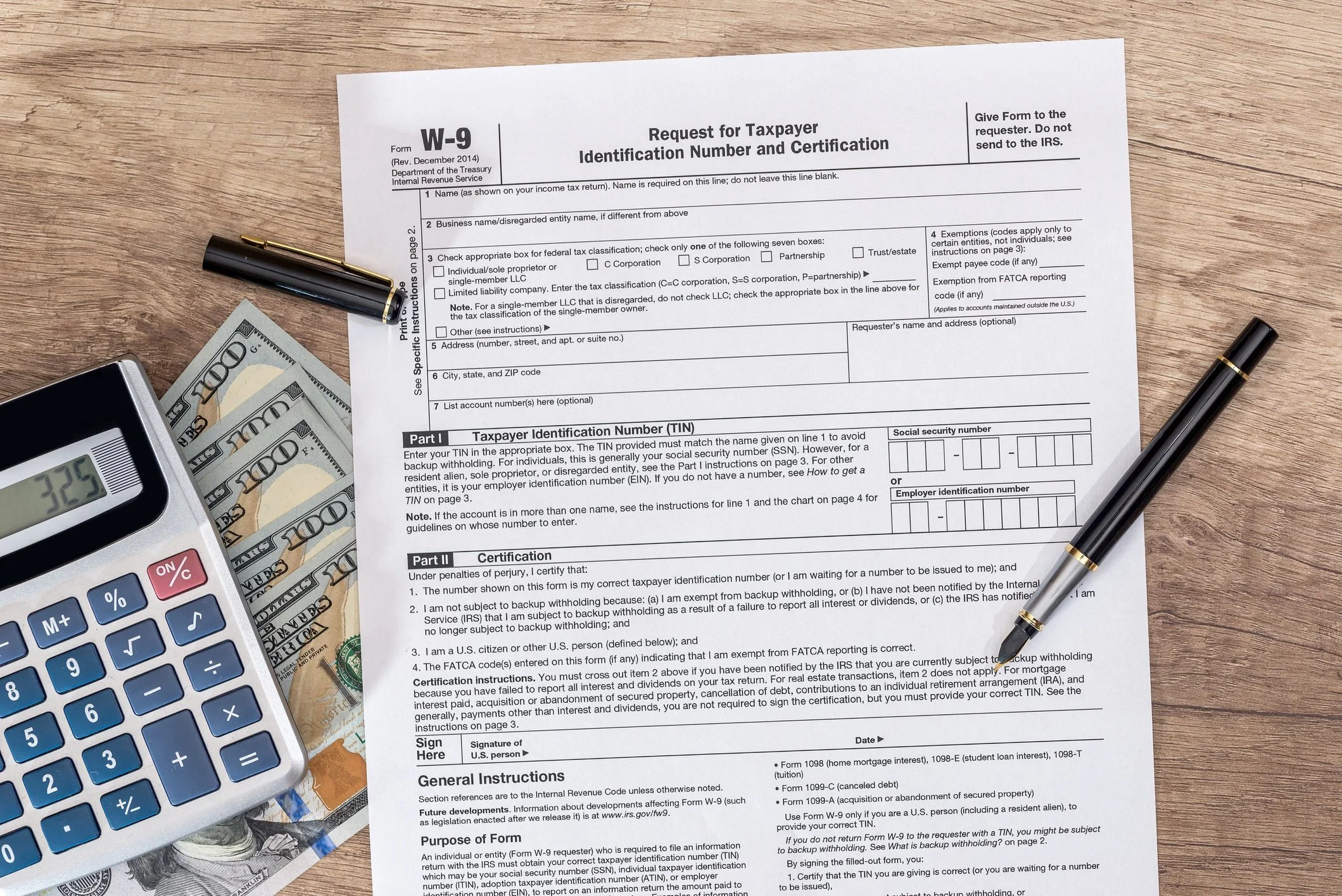

W-9

Businesses and contractors often require a W-9 form for tax and compliance purposes. Here’s why you might need mine:

Tax Reporting: The W-9 provides my Taxpayer Identification Number (TIN), which is necessary for issuing Form 1099 for payments.

Verification: It confirms my legal name and business entity type for accurate records.

Compliance: Many organizations require a W-9 before processing payments to meet IRS regulations.

Avoid Penalties: Having the correct W-9 on file helps prevent reporting errors and potential fines.